Carbon Clean, a leader in revolutionising carbon capture solutions, has achieved a fabrication milestone on Ørsted’s FlagshipONE project, Europe’s largest commercial-scale eMethanol facility under construction. The first equipment has been mounted on the structural steel of the first module, marking the start of the module assembly process. Once operational, Carbon Clean’s technology will be capable of capturing 70,000 tonnes of biogenic CO2 per year for Ørsted’s facility in Örnsköldsvik, Sweden.

Carbon Clean’s CaptureX semi-modular technology for this project is being fabricated at Schwartz Hautmont’s site at the Port of Tarragona in Vila-seca, Spain. This demonstrates the economic benefits that carbon capture brings to the local supply chain, both in Vila-seca and beyond.

FlagshipONE will be Ørsted’s largest commercial-scale Power-to-X facility and Europe’s largest eMethanol plant, and is expected to be operational in 2025. It will supply up to 55,000 tonnes of eMethanol per year to the shipping industry, which today accounts for around 3% of global carbon emissions.

Aniruddha Sharma, Chair and CEO of Carbon Clean, said: “This fabrication milestone underscores how Carbon Clean is on track with delivery for this pioneering eFuel project. The complexity and scale of the challenge is huge, and the Carbon Clean team continues to deliver in a timely manner against targets, with an unwavering commitment to technical excellence. Carbon capture technology is essential in decarbonising hard-to-abate sectors, such as shipping, but it also brings economic benefits through the development of local supply chains.”

FlagshipONE was developed by Liquid Wind, which has plans for several additional plants in the Nordics. In February 2024, Liquid Wind together with international decarbonisation leaders Alfa Laval, Carbon Clean, Siemens Energy and Topsoe opened an eFuel Design & Performance Centre (DPC) in Hørsholm, Denmark. By leveraging partners’ innovative technologies and modular solutions, the DPC will deliver ready-to-build eMethanol plants that are quicker to fabricate, transport, construct and commission.

Carbon emissions from shipping have proven hard-to-abate, but eMethanol is widely believed to be the best scalable green shipping fuel for the next decade. When used as marine fuel, eMethanol reduces carbon emissions by 94% compared to current fossil fuels.

Carbon Clean | www.carbonclean.com

More than CAD1 billion were spent retrofitting the Boundary Dam 3 (BD3) coal plant in Saskatchewan to add carbon capture technology. After nine years, the project has a consistent history of capturing far less than the 90% promised when the project was built—and all the carbon dioxide (CO2) captured at the plant is used for enhanced oil recovery (EOR) that injects captured CO2 into the ground to extract more oil.

In April 2021, IEEFA published a short analysis responding to project owner SaskPower’s claim that capturing 4 million metric tons of CO2 at Boundary Dam 3 was a milestone “to be proud of.” The coal plant did capture its four millionth metric ton of CO2 in March 2021, but it reached that mark two years later than had originally been forecast—highlighting the project’s inability to sustain the 90% capture rate promised by SaskPower and other proponents.

The project’s performance has not improved since.

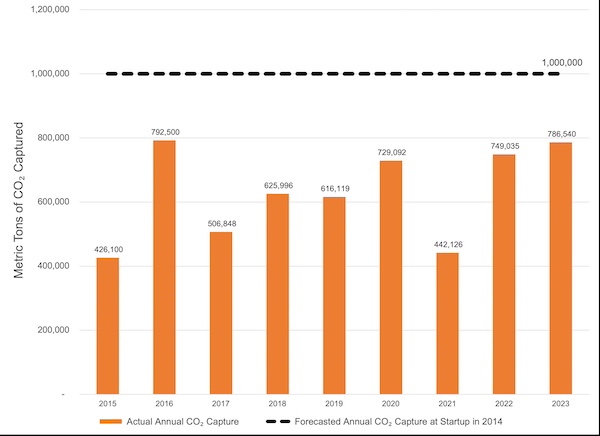

SaskPower data shows that the project had captured less than 5.8 million metric tons of CO2 as of the end of 2023. This is just 63% of the 9.2 million tons it would have captured if it had actually hit the 1 million tons per year (or 90%) mark that SaskPower initially claimed. This means that BD3’s long-term CO2 capture rate through the end of 2023 was 57% (that is, 63% of 90%).

As can be seen in Figure 1, BD3 has never achieved the stated goal of capturing 1 million metric tons of CO2 each year.

Figure 1: Boundary Dam 3 Annual CO2 Capture from January 2015 to December 2023

Sources: SaskPower monthly and quarterly Boundary Dam 3 Status Updates.

Despite this poor performance, CCS proponents still make false claims about how well carbon capture has worked at Boundary Dam. For example, Eadbhard Pernot, carbon capture policy manager for the Boston-based Clean Air Task Force, has claimed that “the project has consistently performed at its capacity. And I think that’s really something Canada should be proud of.” Figure 1 shows that statement is patently false.

To be considered a success, a carbon capture project must capture all or almost all CO2 produced by the facility (power or industrial plant) to which it is attached and must do so for decades. SaskPower’s own CO2 capture data shows that Boundary Dam’s overall capture rate during its nine years in service has been closer to 50% than 90%.

A paper by SaskPower and the International CCS Knowledge Centre first acknowledged in October 2022 that BD3 had not sustained its planned 90% capture rate since 2015. It then provided the following insights into BD3’s failure.

First, a key reason for BD3’s underperformance is that the carbon capture portion (CCP) of the plant has been available to capture CO2 during only about 80% of the hours that the power plant has been in operation. During the remaining 20% of the hours the plant has been available, its flue gases containing the CO2 have been emitted directly into the atmosphere—with no CO2 being captured.

But even when the CCP has worked, not all the plant’s flue gases and the CO2 they contain are processed by the carbon capture portion. According to the Knowledge Centre’s paper, the entire facility typically operates with only an average of 73% of the full flue gas going to the CCP. The remaining 27% of the flue gases and their CO2 have been released into the atmosphere.

In summary, the BD3’s CCP operates only about 80% of the hours that the power plant is running. And even when running, it only processes an average of 73% of the flue gases from the plant. Given these circumstances, it is no surprise that BD3’s actual long-term CO2 capture rate has been about 57%—not 90%.

Beyond the plant’s poor performance, there also are serious environmental concerns regarding the use of the captured CO2 that is sold for EOR activities.

The U.S. government has estimated that injecting a metric ton of CO2 for EOR can produce between two and three barrels of additional oil, depending on the underground geology of the oil field and the difficulty of extracting the oil. It also is estimated that burning a barrel of oil or using it as a petrochemical feedstock releases almost half a tonne of CO2 into the atmosphere. This means that if injecting a metric ton of CO2 for EOR conservatively produces just 2¼ barrels of oil, more than a tonne of CO2 will be emitted when the oil is used, assuming all CO2 injected into the ground for EOR actually stays there.

The bottom line is that Canada’s billion-dollar bet on carbon capture at Boundary Dam 3 has been a bust. The technology has badly underperformed, capturing only roughly 57% of the plant’s CO2 emissions in its nine years of operation and never hitting the annual 90% capture target. In addition, since the CO2 that is captured is being used for EOR activities, it is likely that the capture and reuse of the CO2 has led to an increase in global CO2 emissions.

Canadians should not be proud of the money and resources wasted on carbon capture, and they should be especially concerned about the billions of dollars now earmarked for additional carbon capture investments. Carbon capture is not a solution to the world’s climate crisis, especially when coupled with enhanced oil recovery.

IEEFA | ieefa.org

James Fisher and Sons plc (James Fisher) has been awarded a contract worth over £1 million for the provision of high voltage (HV) specialist personnel and HV safety management services at the Zhong Neng offshore wind farm in Taiwan.

Developed in collaboration with the China Steel Corporation and leading Danish developer Copenhagen Infrastructure Partners, the Zhong Neng offshore wind farm will comprise of 31 turbines which are set to generate 300MW of renewable electricity, enough to power approximately 300,000 households.

Maida Zahirovic, Head of Renewables at James Fisher, says:

“Taiwan has ambitious plans to achieve 20 percent renewable energy generation by 2025, and the growth in its offshore wind industry will play a significant role in this. As with any ambitious growth plan, the journey won’t be without its challenges - but with collaboration across the entire supply chain and experienced industry players, Taiwan will soon enjoy a thriving renewables sector.

“We’re delighted to be working with Zhong Neng as we continue to champion the expansion of renewables across Taiwan and Asia Pacific more broadly”.

James Fisher’s Renewables team will securely manage the high voltage network and electrical safety throughout the construction and commissioning phases of the onshore substation and wind turbine generators, spanning approximately 10 months. Working under a tailored set of safety rules and procedures, James Fisher Renewables will ensure the safe energisation of Zhong Neng’s HV network, and a seamless transition for operations in the region.

Emma Su, APAC Operations Specialist at James Fisher Renewables, says:

“This project is another string to our bow within Asia Pacific, and a further signal of our commitment to the growth of renewables in the region. We are dedicated to helping build the foundations to advance Taiwan’s renewable energy landscape, both by bringing our own expertise, and crucially, developing the local workforce and supply chain.

“Our proven and extensive track record of delivering niche expertise for some of the most technically challenging project scopes and our dedication in delivering exceptional safety standards means our team is an ideal fit to deliver installation and commissioning services for this important phase at Zhong Neng.”

James Fisher Renewables has supported twenty-eight projects in the Asia Pacific region to date, including works at The Changfang and Xidao Offshore Wind Project (CFXD), phase II of the Taiwan Power Company (TPCII), Greater Changhua, Formosa 1 and 2 and the Yunlin project, helping accelerate offshore wind development through industry collaboration in the region.

James Fisher and Sons plc | www.james-fisher.com

LiNova Energy Inc. (Linova) has raised $15.8 million in a Series A financing round that was led by Catalus Capital, who were joined by Saft, a subsidiary of TotalEnergies, Chevron Technology Ventures and a syndicate of investors. LiNova will use the funds to accelerate its mission to revolutionize the energy storage landscape with its polymer cathode battery.

This significant financial milestone will enable LiNova Energy to expand its research and development efforts, scale up operations, and accelerate the commercialization of its cutting-edge batteries. LiNova has developed a high-energy polymer battery technology that is designed to allow material replacement of the traditional cathode containing cobalt, nickel, and other critical materials.

LiNova also announced that it has entered into a joint development agreement with Saft, pursuant to which LiNova and Saft will work together to develop the battery technology for commercialization in Saft's key markets. "We are proud to collaborate with LiNova in scaling up its technology, leveraging the extensive experience of Saft's research teams, our newest prototype lines, and our industrial expertise in battery cell production." said Cedric Duclos, CEO of Saft.

"The technology developed by LiNova is designed to have higher energy density while providing a safer, lighter and lower-cost solution to the battery market," said Jim Gable, Vice President, Innovation and President of Technology Ventures at Chevron. "This is the latest investment from our $300 million Future Energy Fund II, which focuses on industrial decarbonization, emerging mobility, energy decentralization, and the growing circular economy. We welcome LiNova Energy to the portfolio."

"We are excited to lead LiNova's Series A round and support their path to commercial success," said Saif Qazi, Vice President at Catalus Capital. "LiNova's innovative polymer cathode technology is a strong addition to our energy storage portfolio. Catalus' investments in the space are focused on companies that combine a sound technical foundation with a capable management team and a robust commercial plan. LiNova is emblematic of this approach. We look forward to a successful partnership."

"We are grateful for the support and confidence of our investors," said Michael Nagus, CEO of LiNova Energy. "This funding is a testament to the potential of our technology and the impact it will have on delivering a more sustainable battery for the world's energy storage needs. With this investment, we are well-positioned to advance our mission and bring our innovative polymer cathode batteries to market."

Catalus Capital, Chevron Technology Ventures, and Saft bring a wealth of experience and strategic resources to the table, which will be instrumental in guiding LiNova Energy's growth trajectory.

As LiNova Energy moves forward, the company is committed to leveraging this investment to make significant strides in the battery technology sector, driving innovation, and delivering value to its customers and stakeholders.

LiNova Energy | https://www.linovaenergy.com/

Matrix Renewables, the TPG Rise-backed global renewable energy platform, announced that it has signed a renewable energy power purchase agreement with affiliates of the Hyundai Motor Group for 147 MWac from its Stillhouse Solar project, a 284 MWdc / 210 MWac total solar PV project located in Bell County, Texas (USA). The Stillhouse Solar project is expected to begin commercial operations in the second part of 2025.

"We are thrilled to have finalized this agreement with Hyundai Motor Group, contributing to the achievement of its ambitious sustainability objectives in the United States," said Cindy Tindell, Managing Director and Head of U.S. for Matrix Renewables. "Stillhouse Solar will provide clean power, deliver grid resiliency and avoid 200,000 metric tons of CO2 equivalent annually. These environmental attributes are in addition to the economic benefit for the Bell Countyregion in Texas. We greatly value the communities in which we develop, construct and operate our projects and are committed to ensuring our projects benefit those communities. We thank Hyundai Motor Group for its commitment to our Stillhouse Solar project and look forward to an enduring relationship."

"Hyundai Motor Group is excited to be a part of the Stillhouse Solar project and looks forward to making a sustainable contribution through this project to our manufacturing plants in the U.S.," said Sung Hwan Bae, Vice President and Head of Corporate Business Planning Team at Hyundai Motor Group. "As a smart and sustainable mobility solutions provider, we will further pursue environmental efforts and expand renewable energy solutions into our worldwide facilities."

In the U.S., Matrix owns over 6.7 GW of projects in operation and in various stages of development across four different regions (CAISO, MISO, ERCOT and WECC) and continues to expand its pipeline and team to capitalize on the large demand for renewable energy in the U.S. Globally, Matrix's portfolio already exceeds 14 GW of solar power, battery storage and green hydrogen projects.

Matrix was represented by Sidley. Hyundai Motor Group was advised by 3Degrees and represented by K&L Gates.

"3Degrees is proud to have played a supporting role to Hyundai Motor Group in executing this PPA. The collaboration between Hyundai Motor Group and Matrix Renewables in bringing this new renewable energy project online is exactly the type of urgent action required to meet the demands of a rapidly warming climate and achieve global emission reduction targets," said Steve McDougal, CEO of 3Degrees.

Matrix Renewables | www.matrixrenewables.com

Nuvve Holding Corp. ("Nuvve") (Nasdaq: NVVE), a global technology leader accelerating the electrification of transportation through its proprietary energy management and aggregation platform, and Guangzhou Great Power Energy and Technology Corporation ("Great Power)" (NCY: 300438.SZ), a global leader in lithium-ion battery manufacturing and research and development, are pleased to announce a strategic partnership to accelerate stationary storage battery deployments and their integration with the grid.

Great Power, established in 2001 with a vision to become a global leader in battery storage technology, recognizes the potential of combining its stationary batteries with electric vehicle charging infrastructure to offer significant product differentiation and market advantage. By leveraging Nuvve's expertise in energy management, flexibility, monetization, and aggregation platforms, Great Power aims to expand its global footprint while enabling savings and new revenue streams for its customers.

Gregory Poilasne, CEO of Nuvve, states, "We're excited about the partnership with Great Power, a leading global battery manufacturer, and their alignment with our energy management approach to electrification. By integrating stationary storage solutions at the edge of the grid where it is the weakest, we're able to strengthen it while enabling a smarter integration of EVs and renewables."

Yang Xia, Head of Great Power global ESS of Great Power, states, "I am thrilled to announce our partnership with Nuvve to deploy advanced battery systems for electric vehicle (EV) charging solutions. Great Power's state-of-the-art battery technology, powered by Nuvve's industry leading software platform will significantly reduce cost and charging times, helping to eliminate one of the main barriers to EV adoption and paving the way towards a more sustainable future and asserting our leadership in global battery technology."

Nuvve's GIVe platform, known for its bidirectional energy management capabilities and energy management solutions, will play a pivotal role in transforming electric vehicles and stationary batteries into grid-integrated energy storage resources. This partnership will enable consumers, fleet operators, utilities, municipalities, and public organizations to optimize energy usage, reduce costs, and support the integration of renewable energy sources such as solar and wind.

Some of the key aspects of this partnership include:

The Nuvve-Great Power integrated solution will enable lower energy costs, resiliency via microgrid, and system control of charging and discharging to utility service limitations. "Our techno-economic modeling demonstrates significant energy savings from Nuvve's total energy management for customers, particularly in areas with high energy rates or demand charges. In the San Diego area, a typical school district purchasing energy from the local utility could save up to 40% or more on their bill by adding in a single Nuvve 400 kilowatt-hour (kWh) BESS. V2G technology and grid services like Demand Response increase those savings." said Hamza Lemsaddek, Nuvve's Vice President of Technology and Astrea AI.

A key milestone of this partnership will be the completion of the integration of the Great Power battery solutions with Nuvve's EMS and GIVe platform, in Q3 2024. Nuvve and Great Power will solidify the commitment of both organizations in a long-term relationship aimed at driving innovation and sustainability in the electric vehicle and renewable energy sectors by packaging a joint offer, including EV infrastructure, stationary storage, and energy management.

"We are witnessing a remarkable era of growth in the sectors of energy storage and electric vehicle (EV) charging, pivotal to advancing the clean energy transitions," said Dr. Evan Bierman, President of Great Power North America. "By collaborating with local partners, we aim to tailor our cutting-edge solutions to better meet the unique needs of the American market and ensure that the infrastructure for EVs is both robust and resilient. This strategic move not only enhances the US supply chain but significantly bolsters the local economies and supports the U.S. in maintaining its competitive edge in green technology on the global stage."

Initial deployments include Nuvve's RESCHOOL and Fresno projects, as well as deployments at other select school districts. The two companies are also working on a combined project pipeline throughout North America, Europe, and Asia.

Nuvve | www.nuvve.com

Great Power | www.greatpower.net

Southern Power, a leading U.S. wholesale energy provider and subsidiary of Southern Company, announced that the 150-megawatt (MW) South Cheyenne Solar Facility in Laramie County, Wyoming, is now operational. This project, Southern Power's 30th solar facility, is Southern Power's first solar facility in Wyoming, and it contributes to the company's growing fleet of clean energy resources from California to Maine.

"We are thrilled to announce that South Cheyenne Solar has reached commercial operation, marking a significant milestone for our team and all who have worked tirelessly on this project, and we are equally excited to see our footprint expand with our first operational site in Wyoming," said Southern Power President Robin Boren. "This facility showcases our commitment to the development of solar energy and is an excellent addition to our growing renewable fleet."

The electricity and associated renewable energy credits generated by the facility will be sold under a 20-year power purchase agreement with Cheyenne Light, Fuel and Power, a subsidiary of Black Hills Energy. The energy will be used exclusively to provide renewable energy to a data center customer.

Southern Power acquired South Cheyenne Solar Facility from Qcells USA Corp. (Qcells USA), in September 2023. Qcells USA provided full renewable value chain and turnkey services on the project including serving as the project developer, module manufacturer and engineering procurement construction (EPC) provider of the site, which created more than 200 jobs at peak construction.

With the addition of South Cheyenne, Southern Power's solar portfolio includes more than 2,740 MW of solar generation. Southern Power's solar facilities are a part of the company's 5,280 MW renewable fleet, which consists of 30 solar and 15 wind facilities operating or under construction.

This project aligns with Southern Power's overall business strategy of strengthening its wholesale business by acquiring and developing generating assets that are covered by long-term contracts with counterparties with strong credit support.

Southern Company | www.southerncompany.com

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

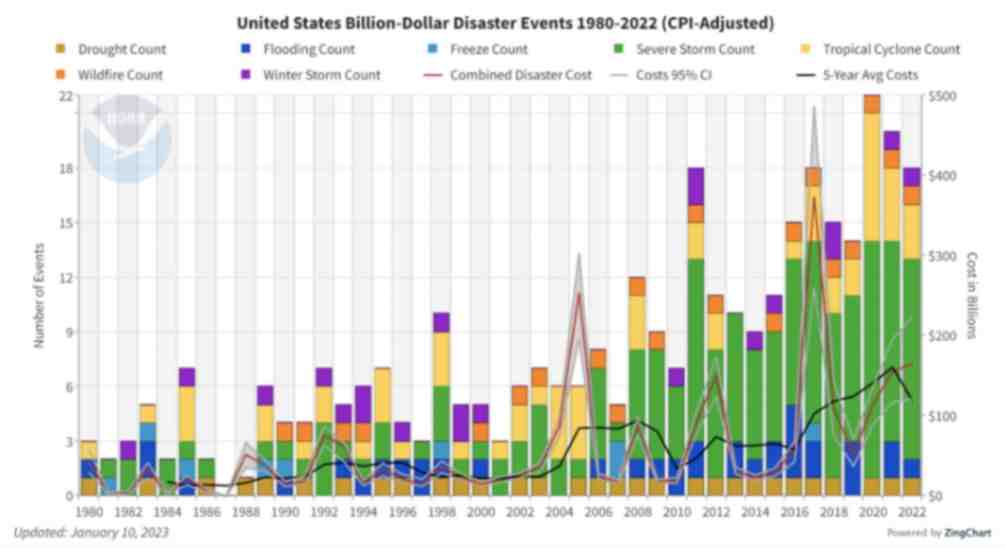

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Battery energy storage is a critical technology to reducing our dependence on fossil fuels and build a low carbon future. Renewable energy generation is fundamentally different from traditional fossil fuel energy generation in that energy cannot be p....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....